Weekly Mass Torts Bulletin 2024-September-30

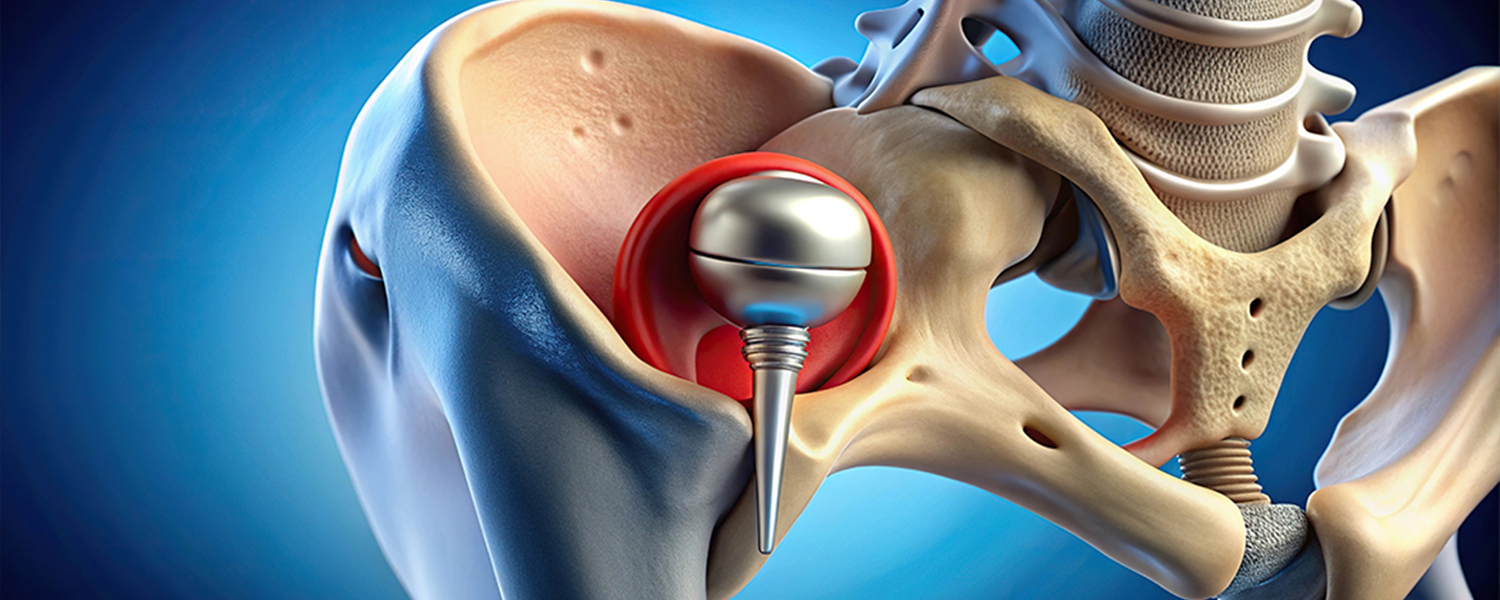

FDA Warns of High Fracture Risk With Zimmer Biomet Hip Device

The U.S. Food and Drug Administration (FDA) has issued a safety alert regarding an increased risk of thigh bone fractures associated with the Zimmer Biomet CPT Hip System, which had previously been recalled.

FDA advises patients, caregivers, healthcare providers, and facilities to consider alternative prostheses when possible. If the use of the CPT Hip System is necessary, patients should be informed of the elevated risk.

The CPT Hip System Femoral Stem 12/14 Neck Taper, a polished-taper slip (PTS) style stem made from cobalt chromium alloy, is commonly used in hip replacement surgeries. However, recent studies have revealed a higher likelihood of postoperative periprosthetic femoral fractures (thigh bone fractures after surgery) with this device compared to similar hip prostheses.

In early July, Zimmer Biomet recalled the CPT Hip System to update its instructions for use due to the increased fracture risk and announced plans to phase out the product by December 2024. Despite this, the FDA has expressed concerns about the continued use of the system for new patients, given the elevated risk of fractures and the potential need for additional surgery if a fracture occurs.

The FDA is working with Zimmer Biomet to address these concerns and ensure that all parties involved—patients, caregivers, and healthcare professionals—are aware of the risks associated with the CPT Hip System. The agency will continue to monitor the situation to help minimize the risk of injury and ensure patient safety.

Baltimore to Sue Drug Distributors Over Opioid Crisis

Baltimore is set to go to trial in its $11 billion lawsuit against drug distributors McKesson and Cencora (formerly AmerisourceBergen), accusing them of contributing to the opioid addiction crisis and overdose deaths that have devastated the city.

The city chose to opt out of national opioid settlements, aiming to secure more compensation by pursuing its case independently. Jury selection for the trial will begin in the Circuit Court for Baltimore City, Maryland.

The lawsuit alleges that McKesson and Cencora ignored warning signs that the opioids they distributed were being diverted into illegal markets, exacerbating the opioid crisis. Baltimore argues that these companies should be held financially accountable for the costs associated with addressing the epidemic.

In response, Cencora stated that it does not control the supply or demand for medications but distributes opioids based on prescriptions written by doctors. The company also emphasized that it reported suspicious orders to U.S. authorities. McKesson has not yet commented on the case.

Baltimore had also planned to take Johnson & Johnson's Janssen division to trial over allegations that it downplayed the risk of addiction when marketing its opioid drugs Duragesic and Nucynta. However, the city reached a settlement with Janssen over the weekend, though the terms were not disclosed. Johnson & Johnson has denied the allegations and declined to comment on the settlement.

Baltimore is one of more than 3,000 local governments, Native American tribes, and states across the country that have filed lawsuits against drug manufacturers, distributors, and pharmacies over their roles in the opioid crisis. While most of these cases have been resolved through nationwide settlements totaling around $46 billion, Baltimore and other jurisdictions hard-hit by the crisis have opted out of these agreements, hoping to secure larger payouts by going to trial.

In 2022, Baltimore recorded 904 opioid overdose deaths, despite its population of only 569,000. This is significantly higher than the national opioid overdose death rate of about 25 per 100,000 people. The city has already secured $402.5 million in settlements with pharmacy operator Walgreens and drugmaker Teva ahead of the trial.

Choosing to opt out of the national settlements comes with both potential rewards and risks. For instance, San Francisco won a $230 million settlement from Walgreens after a trial victory, marking the largest payout for any local government. Similarly, West Virginia, another opt-out state, secured about $1 billion in opioid settlements, the highest recovery per capita of any state.

However, not all opt-outs have been successful. The city of Huntington, West Virginia, and its surrounding county lost their trial against McKesson, Cencora, and Cardinal Health after a judge dismissed their public nuisance claims, which are similar to those brought by Baltimore. If Huntington and its county do not overturn the decision on appeal, they will not receive any compensation from the distributors.

McKesson was responsible for distributing about half of the opioids in Baltimore between 2006 and 2019, according to U.S. government data. In 2017, McKesson reached a $150 million settlement with the U.S. Department of Justice, admitting it had failed to prevent the illegal sale of opioids nationwide. The judge presiding over Baltimore’s trial has ruled that jurors will be allowed to hear about this prior settlement. Additionally, Cencora is currently facing a civil lawsuit brought by the Justice Department over its alleged involvement in the opioid crisis.

The opioid epidemic has claimed the lives of more than 800,000 people in the United States between 1999 and 2023, according to the U.S. Centers for Disease Control and Prevention. Baltimore’s trial could set a precedent for other jurisdictions that opted out of national settlements and are seeking accountability from companies linked to the crisis.

J&J Files Third Bankruptcy to Resolve Talc Cancer Lawsuits

In an effort to settle tens of thousands of ovarian cancer lawsuits linked to its talcum powder products, Johnson & Johnson has once again turned to a controversial bankruptcy strategy.

The company has transferred all liability from these lawsuits to a newly created subsidiary, Red River Talc LLC, which has now filed for Chapter 11 bankruptcy protection. This legal maneuver, often referred to as the Texas Two-Step, will likely delay upcoming trial dates in the litigation.

On September 20, Johnson & Johnson announced in a press release that Red River Talc LLC had filed for bankruptcy. This subsidiary has been assigned legal responsibility for approximately 62,000 lawsuits involving the company's Baby Powder and Shower-to-Shower products. Plaintiffs in these cases, primarily women, allege that they developed ovarian cancer after using the talc-based products for years in their genital area.

This is Johnson & Johnson's third attempt to resolve the talcum powder litigation through bankruptcy. The Texas Two-Step strategy involves creating a subsidiary solely to file for bankruptcy, effectively limiting the financial liability of the parent company. Critics argue this tactic exploits the U.S. bankruptcy system, allowing profitable corporations to cap their liability and avoid full accountability for the harm they have caused.

Johnson & Johnson had previously tried to move these lawsuits into bankruptcy using another subsidiary, LTL Management. However, federal judges dismissed these attempts, ruling that there was no legitimate financial reason for bankruptcy protection, given Johnson & Johnson's strong financial standing.

In May 2024, Johnson & Johnson offered a $6.5 billion settlement fund to resolve the current and future Baby Powder lawsuits. However, the company has since increased the proposed settlement fund to $8 billion, according to the Chapter 11 bankruptcy filing submitted by Red River Talc LLC in the U.S. Bankruptcy Court for the Southern District of Texas on September 19, 2024.

To approve such settlement plans, bankruptcy courts typically require the support of 75% of the claimants. Johnson & Johnson claims that 83% of the plaintiffs have agreed to the proposed settlement, but legal challenges are still expected.

Since 2016, the federal talcum powder cancer lawsuits have been centralized in the U.S. District Court for the District of New Jersey, due to the common legal and factual issues presented by the cases. While numerous state court trials have resulted in substantial verdicts against the company, no federal trial has yet taken place. A bellwether trial, intended to test the strength of the evidence, is scheduled for December 2024. This trial will be closely monitored to determine how juries might react to the evidence and expert testimony in future cases, should a global settlement not be reached.

However, Johnson & Johnson’s repeated use of bankruptcy filings has significantly delayed the legal process. The company has consistently requested that litigation be paused while its bankruptcy plans are under review, a tactic that could result in further postponement of the upcoming trial. Plaintiffs’ attorneys argue that these delays are unfair to their clients, many of whom are seriously ill or have passed away without having had the chance to present their cases in court.

Johnson & Johnson has already resolved 95% of lawsuits related to mesothelioma claims linked to talcum powder exposure. The remaining cases primarily involve gynecological cancers, with a focus on ovarian cancer. Although the company has agreed to remove talc from its Baby Powder products, it continues to deny that its products posed any health risks.

The company's bankruptcy filing aims to limit its financial exposure while resolving the litigation, but it remains to be seen whether the courts will allow this maneuver to proceed. Meanwhile, the thousands of women affected by the company's talc-based products await justice, as Johnson & Johnson's legal strategies continue to prolong the process.